The Federal Government Shouldn’t Seize A Share In U.S. Steel

TPA’s David McGarry in Issues & Insights

Markets are not static. To remain competitive, businesses require flexibility. If the materials U.S. Steel requires to operate can be had more cheaply from non-American suppliers, the state should not prevent it. Higher input costs mean higher prices for American businesses that consume steel products, sapping U.S. Steel’s competitive vigor and rendering the larger American manufacturing sector poorer.

Removing Barriers to Prosperity: A Free Trade Center Interview

David McGarry and Iain Murray

America was on the path towards free trade for the decades following World War II. But for the last three presidential administrations, protectionism has been gaining ground. What went wrong? And as importantly, what can be done going forward to turn the U.S. back towards free trade? Research Director David McGarry and the Competitive Enterprise Institute’s Iain Murray discuss.

The Tariff Power Properly Belongs with Congress

The Editors, National Review

The Founders rebelled against taxation without representation; they did not mean for the executive to control the duties on all imports by daily whim.

It is Congress that was granted power by the Constitution to “lay and collect Taxes, Duties, Imposts and Excises” and to “regulate Commerce with foreign Nations,” and for good reason.

The Paradox of Protectionism: How Tariffs Hurt the Businesses They’re Supposed to Help

Paul Best, Cato

Clifford Digre flew 17 combat missions as a ball turret gunner and six as a radio operator during World War II, returning home in 1945 and settling near Minneapolis with his wife. Fascinated by the rapid advancement in electronics during America’s war effort, he decided to go to school to become a licensed radio operator but then pivoted after identifying a massive hole in the market during the postwar economic boom.

Digre had been struggling without success to find someone to repair his wife’s broken radio, eventually deciding to just recone the malfunctioning speaker himself with the help of some classmates at radio school.

Read More>>

Econ 101 is Wrong about Tariffs

Brian Albrecht, Economic Forces

I’ve taught thousands of economics students the introductory model of tariffs: a tariff on washing machines raises their price, harming households, but benefiting U.S. manufacturers. The households’ loss is larger, so the tariff ends up destroying wealth for the country. This conclusion makes economists unpopular with many politicians.

Recent research has convinced me that the Econ 101 story is generally too simple to apply in a modern economy. Pro-tariff politicians are right about that. But they have the direction wrong: tariffs are even worse than the textbook model suggests.

It’s usually not the main takeaway, but there is an upside to tariffs in the basic model; tariffs benefit domestic manufacturers. The standard trade model taught in Econ 101 is shown below. It’s supply and demand, but where the usual sloped curves are only the domestic supply and demand.

Read More>>

About Trump’s ‘Reciprocal’ Tariffs

Pat Toomey, WSJ

Donald Trump recently declared that only stupidity could explain my opposition to his reciprocal-tariff proposals. There are other explanations. Concern for Americans’ jobs and standard of living comes to mind.

I understand the emotional appeal of trade-rules reciprocity—it satisfies an urge for revenge. But that revenge will be less satisfying for the working-class Americans facing unemployment and higher prices if Mr. Trump carries through on his import-tax promises.

As I tried to explain to Mr. Trump when he was president, another country’s misguided decision to tax its citizens on what they buy from American manufacturers isn’t a good reason to punish Americans who wish to buy that country’s products. But Mr. Trump is determined to punish American consumers for the misfortune indirectly imposed on our export-heavy manufacturers. This is his idea of fairness.

Read More>>

No, Tariffs Don’t Fuel Growth

Phil Gramm and Donald J. Boudreaux, WSJ

Modern protectionists are desperate to find historical examples of tariffs promoting industrialization and economic growth. To this end, they increasingly argue that 19th-century America’s extraordinary economic success was fueled by high tariffs. In an essay for the Economist, former U.S. Trade Representative Robert Lighthizer insists that “when America grew in the 19th century from a modest agricultural country into the world’s largest economy, tariffs were critical to its success.” Oren Cass writes that “behind some of the world’s highest tariff barriers, the United States transformed from colonial backwater to continent-spanning industrial colossus.” Michael Lind says the U.S. during the 19th century “pursued a successful import substitution strategy that transformed it from an agrarian to an industrial economy with the help of tariffs.”

Read More>>

Why We Need Free Trade: A Free Trade Center Interview Series

Today, the Taxpayers Protection Alliance (TPA) launched a new video series to explore the economic consequences of tariffs and protectionism. Guests will include scholars and business people, who will explain why protectionists fail and how they affect American businesses and workers. In the first interview, TPA Policy Analyst David McGarry speaks to Mary Jane Saunders, vice president and general counsel at the Beer Institute. They discuss how policy has disrupted the industry in recent years and how things are likely to progress looking forward.

Read More>>

Trump Gets Tariffs Wrong at the Presidential Debate

Donald Trump recommitted himself to protectionism during his first presidential debate with Kamala Harris, held Tuesday night. “I took in billions and billions of dollars…from China,” Trump said of his presidency, as he pledged to levy new tariffs if elected again. The nature of Trump’s confusion surrounding trade is both economic and historical. It is both theoretical and practical. At a recent rally, the former president insisted that protection is “not going to be a cost to you” – the American people – “it’s going to be a cost to another country.”

This economic backwardness cries out for a response from the political right.

Read More>>

Tariff Myths, Debunked

Scott Lincicome, The Dispatch

With the U.S. presidential election mere weeks away, tariffs have become a frequent topic of discussion and, unfortunately, an even-more-frequent source of misinformation. (See, for example, last night’s debate.) For that reason, I’ve decided this week to dedicate an entire column to busting the most common tariff myths I see repeated online—and by a certain Republican presidential candidate—each day.

Read More>>

TPA President Speaks on the Truth about Tariffs

On a Monday edition of Fox45 Morning News, Megan Gilliland spoke with TPA President David Williams to learn the truth about what tariffs do, and the impact they can have on a local economy like Baltimore. Williams says that it's not just Republicans, but both major political parties that are in denial that taxes cause consumer prices to rise.

Watch Now>>

Poll: 63% of Americans Want to Increase Trade with Other Nations, 75% Worry Tariffs Are Raising Consumer Prices

Emily Ekins, Cato

A newly released national survey from the Cato Institute of 2,000 Americans conducted by YouGov finds that two-thirds (66%) of Americans say global trade is good for the US economy, and 58% say it has helped raise their standard of living. This may help explain why 63% of the public favors the United States increasing trade with other nations.

Three-fourths (75%) are concerned about tariffs raising the prices of products they buy at the store. Indeed, two-thirds (66%) of Americans would oppose paying even $10 more for a pair of blue jeans due to tariffs, even if they are intended to help US blue jean manufacturing.

Read More>>

Not-China Is Much Bigger Than China

Dominic Pino, NR

Since China is only one of about 200 countries in the world, these two facts sound scary to policy-makers who increasingly view China as an adversary. They respond with various efforts to get tough on China. Those efforts often include restrictions on trade and investment related to China. And oftentimes the conversation stays within those boundaries.

But the two scary-sounding facts have happy-sounding obverses. Roughly four-fifths of the world’s population is in Not-China. Roughly four-fifths of the world’s economic production comes from Not-China.

From an American perspective, it’s not only the size of Not-China relative to China that is good news.

Read More>>

Protectionism Forgets the Interests of the Average American

Politicians from Franklin Roosevelt to Donald Trump have declared themselves the champions of “the forgotten man.” They claim to support the average working-class American whom Washington has purportedly overlooked and left behind.

To some modern commentators, recalling these forgotten men and women requires a robust tariff regime, designed to benefit domestic industries, especially manufacturing. To this end, Trump became a prolific protectionist, and President Joe Biden has perpetuated and augmented Trump’s anti-trade ideas and schemes. But to refer to the “forgotten man” as the person whom government policies (such as tariffs) intend to help bastardizes the phrase’s original meaning.

Read More>>

New Tariffs Could Boomerang and Reduce Exports by Nearly 20 Percent

Bryan Riley, NTU

Former President Trump has proposed a 10 percent tariff on all imports to the United States. If he followed through on this threat, he would make the United States a high-tariff country by increasing U.S. tariffs to the highest level since 1943.

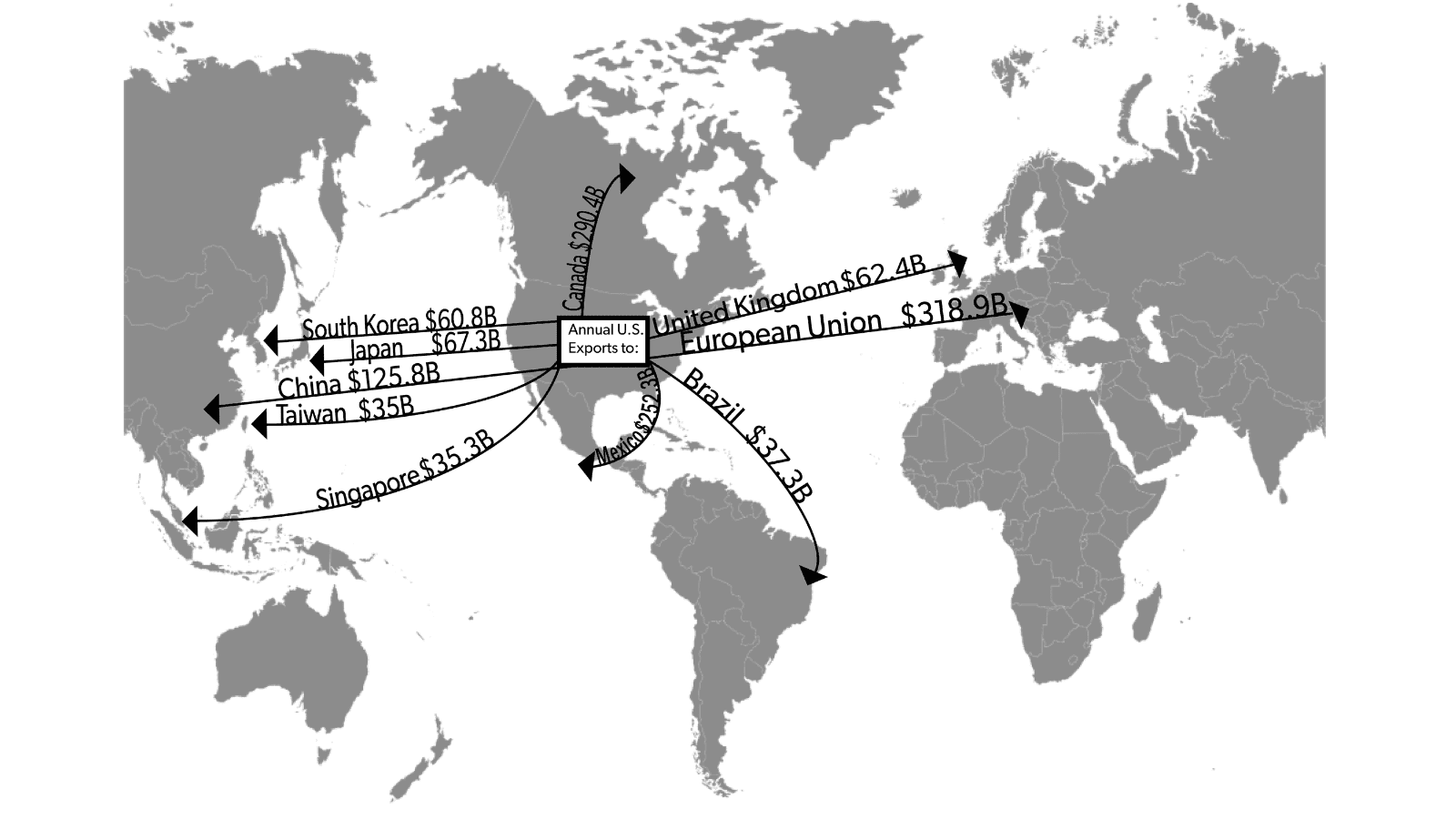

As of 2021, the average foreign tariff on U.S. exports was 5.06 percent. If foreign countries retaliated to match the 10 percent U.S. rate, tariffs on U.S. exports would roughly double. Our biggest export markets would need to impose tremendous hikes in tariffs on U.S. exports in order to match the U.S. rate. The largest U.S. export market, the European Union (EU), is already drafting its plan to retaliate.

Read More>>

Tariff Tracker: Tracking the Economic Impact of the Trump-Biden Tariffs

Erica York, Tax Foundation

The Trade War Timeline

The Trump administration imposed several rounds of tariffs on steel, aluminum, washing machines, solar panels, and goods from China, affecting more than $380 billion worth of trade at the time of implementation and amounting to a tax increase of nearly $80 billion. The Biden administration has maintained most tariffs, except for the suspension of certain tariffs on imports from the European Union, the replacement of tariffs with tariff-rate quotas (TRQs) on steel and aluminum from the European Union and United Kingdom and imports of steel from Japan, and the expiration of the tariffs on washing machines after a two-year extension.

Read More>>

Storm Clouds on the U.S. Industrial Policy Horizon?

Scott Lincicome, Cato Institute

The Industrial Policy Mirage:

Here’s what I told Congress about why subsidies and protectionism don’t work.

Industrial policy is back in Washington. Not only do its supporters claim that it can bring about a market-beating manufacturing renaissance for critical industries, they insist this renaissance has already begun. I’m skeptical for a few reasons. First, while domestic investment in manufacturing and related construction has increased substantially, it must be put into context.

Read More>>

The U.S. Should be Encouraging Digital Trade, not Undermining it

Some policymakers have raised concerns when the U.S., led by United States Trade Representative’s (USTR) Ambassador Katherine Tai, made the decision to back out of negotiations on digital trade at the World Trade Organization. Concerns grew stronger as reports noted that the decision was likely influenced by Federal Trade Commission Chair Lina Khan, in yet another show of her overzealous approach to tech regulation.

With an economy that is increasingly reliant on digital tools, taking the U.S. away from the negotiating table for digital trade rules will create irreparable long-term damage to the U.S. economy.

Read More>>

Op-Ed: How Blatant Self-interest Continues to Drive Trade Policy

Too often, the process of policymaking dissolves from principled debate to battling for regulatory handouts. Politicians fight to secure their constituents flashy and politically popular benefits at the national interest’s expense. This dynamic asserts itself often in trade policy.

The United States, once the champion of global free trade, has pivoted hard towards protectionism under Presidents Donald Trump and Joe Biden. Trump’s efforts failed to resurrect a bygone, mid-century economic status quo. Biden has attempted to induce a premature and wholly infeasible transition to green energy and electric vehicles (EVs).

Read More>>

The New Populist Right Is Making the Same Old Economic Mistakes

In Friedrich Hayek’s famous essay “Why I Am Not a Conservative” (appended to his 1960 book, The Constitution of Liberty), the economist examined the slippery question of what exactly a “conservative” is. Hayek lambasted the European style of conservative, typically someone who distrusts individual liberty, fetishizes authority, and retreats reflexively to central planning.

Read More>>

Senator Floats Garlic As Newest National Security Threat

The U.S. faces rapidly changing and increasingly precarious geopolitical conditions. Americans worry that communist China could become the new global polestar, that a revanchist Russia’s ambitions could stretch Ukraine into NATO, and that unrest in the Middle East could once again entangle the U.S. forces. Now, policymakers have identified a new looming threat: imported garlic.

Read More>>

Biden Administration Introduces Foolish New Tariffs on Tin-Mill Steel

Many industries find it far easier to lobby Washington for special protections and cronyism than to best their competition in the market. They exert potent and targeted pressure on key officials, often obtaining crony policy concessions that, while providing some limited benefit to the petitioners, slow America’s economic growth generally. This is the playbook being used by businesses urging more tariffs.

Read More>>

Op-Ed: DeSantis is wrong about tariffs and industrial policy

Gov. Ron DeSantis (R-FL) recently pledged that he would continue former President Donald Trump’s trade war with China. DeSantis stated, “You need to couple that with tax incentives, tax credits, and even, for things that are really important, like semiconductors … government support.”

Precisely how tax incentives or tariffs differ in principle from so-called “government support” — consisting of payouts on the model of the CHIPS Act of 2021 — DeSantis left unclear. He assumes that subsidization, not deregulation, would best entice businesses to manufacture domestically.

Read More>>

Five Years Celebrating National Beer Day Amid Increased Prices Because of Terrible Tariffs

April 7th is the 14th anniversary of National Beer Day. The annual holiday began in 2009 to commemorate the date in the Cullen-Harrison Act of 1933 that legalized the sale of beer with an alcohol content of 3.2 percent. Upon signing the legislation, then-President Franklin D. Roosevelt famously commented that he thought “this would be a good time for a beer.” Unfortunately, almost a century later, this year is not a good time for American beer drinkers as they continue to pay the price for a misguided trade war.

Read More>>

Taiwan-U.S. Free Trade Agreement Would Set Stage for Post-Coronavirus Economy

Consumers see more options and lower costs on the goods they rely on when international markets open up.

That’s especially the case now as border arrangements remain tenuous due to COVID-19. Fortunately, indications are that the U.S. and Taiwan may soon pursue a free trade agreement.

On August 12, Politico reported, “Taiwan President Tsai Ing-wen… expressed hope of beginning free trade talks with the United States, a long-sought goal that likely would further increase tensions between Washington and Beijing.”

Read More>>

Three Ways That “Buy American” Costs Taxpayers

In recent weeks, reports have indicated that the Trump administration is considering making significant changes to long-standing “Buy American” legal provisions. The administration is reportedly considering making it next-to-impossible for the federal government to procure critical healthcare supplies manufactured abroad, even if the foreign product is significantly cheaper than domestic products. In addition, federal agencies may face legal hurdles procuring medicines and medical devices produced in other countries even if these products aren’t manufactured at all within the U.S.

Read More>>

Watchdog Praises Congress for USMCA Agreement

WASHINGTON, D.C. – Today, the Taxpayers Protection Alliance (TPA) praised Republican and Democratic lawmakers for putting aside partisan politics and agreeing to a compromise version of the United States-Mexico-Canada Free Trade Agreement (USMCA). Originally agreed to by the three North American nations in November 2018, USMCA serves as a successor trade deal to the North American Free Trade Agreement and preserves the free trade zone amongst its signatory countries.

Read More>>

Congress Should Quit Procrastinating on USMCA

Like any high schooler with a short attention span, members of Congress are expert procrastinators and save all the hard work for right before class starts or the few days before vacation. The House is set to adjourn for two weeks, even as key policy issues remain unaddressed. In particular, lawmakers are still negotiating the ins-and-outs of the United States-Mexico-Canada Trade Agreement (USMCA), preliminarily agreed to by the three countries in September 2018. This successor agreement to NAFTA contains key intellectual property (IP) protections, and ratification through Congress is pivotal for continued innovation across the continent. Like (many) high schoolers waiting until the last minute to get their assignments done, hopefully lawmakers ace their homework assignment and get everything right.

Read More>>

Time for Free Trade with Taiwan

The current trade/tariff war has put the U.S. economy at a crossroads as analysts fear an economic “correction” while administration officials predict growth for years to come. Continued trade protectionism keeps prices high for millions of American consumers while inviting other countries to keep American goods off their own markets. Fortunately, a trade opportunity sitting at the administration’s doorstep would be a boon to American commerce and even pave the way for 5G wireless deployment. Negotiating and implementing a free-trade agreement (FTA) with Taiwan would boost American credibility in Asia, signaling to countries across the region that the U.S. is once again open for business. American and Taiwanese households and businesses would benefit from an agreement that gives consumers greater choice, keeps prices lower, and propels technology forward.

Read More>>

In Washington, Some Proposals Like Indexing Capital Gains are Worth Fighting For

For the past eight years, the Taxpayers Protection Alliance (TPA) has tackled many issue areas, made plenty of enemies (and friends), and forced organizations like the United States Postal Service to go on the defensive. Too often, ill-considered policies such as tariffs hog the limelight at the expense of promising proposals such as capital gains indexation. Free-market groups such as TPA, and policymakers, must take a forceful stand against government meddling in the economy while championing continued tax reform. The job isn’t easy, but politicians must be held accountable for the bad and the good.

Read More>>

Summer Reading: Tariffs

If lawmakers have been keeping up with their Taxpayers Protection Alliance Summer Readings this August recess, they’ve picked up vital information on key issues ranging from harm reduction, 5G deployment, and beach umbrellas. These issues are of course very different, but products associated with these issue areas (vaping devices, cell phones, and beach umbrellas) have all experienced price increases due to the Trump administration’s misguided tariff policies. Thanks to an endless trade war with China and other countries, prices on…pretty much everything are far higher than they need to be. Members of Congress must press the Trump administration to reach a deal with China ASAP, or at least before they head to the (shopping) mall for their fall wardrobe (at taxpayers’ expense).

Read More>>

Elizabeth Warren tries to out-Trump Trump on trade

For consumers looking for a reprieve from the ongoing trade war and corresponding cascade of high prices, presidential hopeful Sen. Elizabeth Warren, D-Massachusetts, has a plan or two.

Under the lawmaker’s recently-released trade proposal, the U.S. would trade with…basically no one at all. Warren compiles a lofty list that any potential trading partner would have to meet, including eliminating all fossil fuel subsidies and complying with OECD high-tax “projects.” Sen. Warren’s move to “out-Trump” President Trump would be a recipe for Great Depression-style protectionism and create an environment cruel to workers and consumers alike. Voters deserve free-trade candidates that understand the perils posed by closed ports and trade taxes.

Read More>>