TPA Sounds Alarm on Biased New America IRS E-File Study, Launches New Ad Campaign

Taxpayers Protection Alliance

May 16, 2023

For Immediate Release Contact: Abigail Graham: (202) 417-7235

May 16, 2023

WASHINGTON, D.C. – The Inflation Reduction Act (IRA) earmarked $15 million for the Internal Revenue Service (IRS) to conduct a study on the feasibility of a government run tax-prep system. Just a few months ago, the agency contracted with New America, a left-leaning think tank to conduct that study. Today, New America released their findings that stated the IRS should create and implement their own tax prep system using a pilot program that the IRS built even before the study was completed.

Unfortunately, given that a partisan organization who routinely sings the praises of the IRS has been contracted, it is no surprise that the study results are in support of creating a government-run tax prep system for the very next tax season.

In response, David Williams, TPA President, offered the following comment:

“From the very beginning we knew that the New America study wouldn’t be objective and would recommend giving the IRS more power. New America has frequently supported the expansion of the IRS into tax prep. This was taxpayer dollars spent on producing a study that advocated spending more taxpayer dollars, a double whammy for taxpayers considering their conclusion was never in doubt.

“The majority of Americans don’t want the government to act as tax preparer and enforcer. The IRS continually has data leaks, fails to answer its phones, and audits taxpayers disproportionately. Recent studies show that Black Americans are audited at three to five times higher rates than non-Black taxpayers. Further, lower-income taxpayers claiming the Earned Income Tax Credit (EITC) are similarly audited at a significantly higher rate than others. Before the IRS takes on more responsibilities, they should focus their efforts on addressing these issues.

“The IRS already struggles to operate efficiently with its assigned tasks, there is no reason to give them more responsibility and access to Americans’ private information. TPA urges Congress to reject the proposal to create a government tax prep system.”

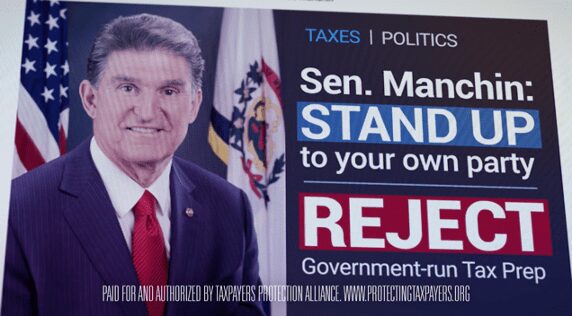

On the day that the biased IRS study was released, TPA also launched a new ad campaign calling on so-called “independent” senators Joe Manchin (D-W.Va.), Catherine Cortez Masto (D-Nevada), Mark Kelly (D-Ariz.), Jacky Rosen (D-Nevada), Kyrsten Sinema (I-Ariz.), and Jon Tester (D-Mont.) to stand up against the far-left wing of their party and oppose the unnecessary and wasteful government-run tax preparation system that the IRS is now trying to implement.

“These lawmakers claim to be independent voices for their constituents, now is the time to prove it,” continued Williams. “According to the IRS’ own survey, voters don’t want a government-run tax prep system, and it’s those voters, and their elected officials, who should ultimately get to decide. It is alarming that unelected bureaucrats are circumventing Congress and trying to amass more power. Now is the time to be clear and reject this IRS power grab.”

You can watch the new video ads here.

###

Taxpayers Protection Alliance (TPA) is a non-profit, non-partisan organization dedicated to educating the public through the research, analysis and dissemination of information on the government’s effects on the economy.