Taxpayer Watchdog Urges Sinema, Kelly to Stand Against Unprecedented Expansion of the IRS that Would Limit Taxpayer Control

Taxpayers Protection Alliance

July 29, 2022

For Immediate Release Contact: Abigail Graham: (202) 417-7235

July 29, 2022

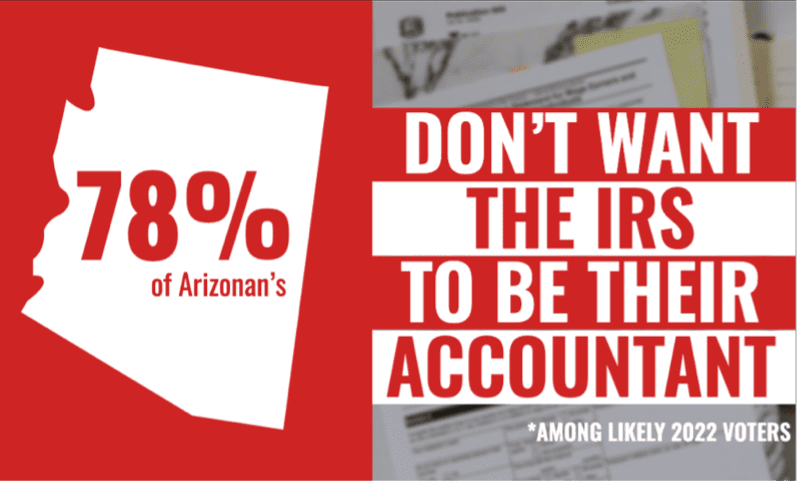

In a 2022 poll, an overwhelming 78% of Arizonans oppose policies that would make the government their accountant

WASHINGTON D.C. – The massive and shortsighted spending package unveiled by Senate Democrats on July 27th includes $15 million that would pave the way for an unprecedented expansion of the IRS that would give the agency more control over U.S. taxpayers and their finances. Recent polling data shows that 78% of voters in Arizona oppose policies that would make the IRS their accountant. Additionally, 58% of Arizona voters would be less likely to support elected officials who want to expand the size and scope of the IRS.

Taxpayers Protection Alliance President, David Williams, offered the following statement:

“With all the real challenges Americans are facing – from high gas prices to empty grocery store shelves – it’s unfathomable that Congress thinks giving the IRS more control over taxpayers is a priority. It’s no wonder that 78% of Arizonans oppose this provision. Senators Sinema and Kelly have been commonsense champions for taxpayers, and I urge them to reject a proposal that would make tax season even more difficult for millions of hardworking families and small businesses that already struggle dealing with the bureaucracy of the IRS.”

The Taxpayers Protection Alliance is running an ad campaign urging Senators Sinema and Kelly to oppose a government run tax preparation system because it would:

- Represent a massive conflict of interest for the IRS to prepare tax returns while also collecting revenue.

- Add immense responsibilities to the IRS even though the agency can’t fulfill its existing mandate and has not asked for this expanded authority.

- Unnecessarily add billions to the federal deficit for a program that a former Obama Administration official called “operationally impractical, prohibitively expensive, and legally questionable.”

- A recent study found that the costs for a potential IRS-run system would rival the costs of Healthcare.gov.

- Give the IRS more authority to target vulnerable or minority populations with additional security months after it was revealed the IRS was five times more likely to audit poorer households.

- A report from CNBC found that this proposal would make it harder for taxpayers to claim critical credits including the earned income tax credit, the child tax credit, the child and dependent care credit and more.

- Needlessly expose the personal data of millions of taxpayers.

- In 2016, hackers accessed the Social Security numbers and other identifiable information from more than 700,000 taxpayers.

- The following year, the IRS officially acknowledged that the agency had targeted groups for audits and additional scrutiny solely because of their political affiliations.

###

Taxpayers Protection Alliance (TPA) is a non-profit, non-partisan organization dedicated to educating the public through the research, analysis and dissemination of information on the government’s effects on the economy.