New Senate Legislation Contains Critical IRS Reforms

Taxpayers Protection Alliance

April 19, 2016

The Internal Revenue Service (IRS) continues to face credibility issues with regards to how the agency has been treating taxpayers and taxpayer information. The Taxpayers Protection Alliance (TPA) has been taking this issue head on, including the submission of Freedom of Information Request Acts (FOIAs) as it relates to recent potentially unethical and possibly illegal conduct by the agency in an ongoing audit.

As with the tax code, the agency that enforces tax law should be working for the taxpayer not instilling fear in American citizens. Working families spend many hours and a great deal of money to comply with a bloated tax code every year. They should expect the agency to treat them with respect and also to have their information secured and have their rights of due process afforded to them if they feel the agency has made an error.

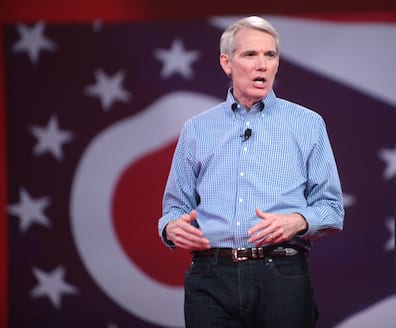

Now, new legislation in the Senate has been introduced and could go a long way in solving some of the issues taxpayers have faced when it comes to the due process part of the ongoing problems at the IRS. Just yesterday (April 18, Tax Day), Sen. Rob Portman (R-Ohio) introduced new legislation aimed at curbing IRS abuses and giving clarity to the due process that must be afforded to all taxpayers. Sen. Portman has a record of protecting taxpayers including his sponsorship in the Senate of the Fair Treatment for All Gifts Act.

The bill has already garnered strong support in the taxpayer advocate community and contains a number of provisions designed to protect taxpayers. The highlights include:

- Guarantees that taxpayers have a right to an appeal before a tax court

- Ensures that the IRS cannot unilaterally extend the statute of limitations against cooperative taxpayers through use of a designated summons

- Prevents the IRS from hiring outside law firms for audits.

The legislation is necessary because going back to the IRS Restructuring and Reform Act of 1998, it is required that the Commissioner of the IRS ensure taxpayers have a right to appeal to the IRS Office of Appeals. Unfortunately, there have been IRS tactics aimed at denying taxpayers the right to appeal, forcing them to pay or go to court. All of the proposed reforms are important, including the last one regarding audits which goes directly to the issue that TPA has been working on for some time now as previously mentioned.

Sen. Portman touched upon recent IRS credibility issues when introducing the legislation yesterday:

“Tax Day this year marks another year where American workers, families, and businesses have been saddled with a complicated, out-of-date tax code. It serves as a reminder that one of the most pressing issues before Congress is pro-growth tax reform that simplifies our tax code, promotes job creation, and makes America more competitive. What’s more, many Americans have lost trust in an IRS that has recently targeted conservative groups and failed to be good stewards of taxpayers’ money and our tax laws.“

Senate Finance Committee Chairman Senator Orrin Hatch (R-Utah), and the full committee, should look to Sen. Portman’s bill as they consider legislation in the coming weeks regarding taxpayer rights

TPA continues to support the efforts in both the House and the Senate to make sure the IRS is acting responsibly for the taxpayer and not working actively against taxpayers. The reforms that Sen. Portman has introduced should be given a fair chance for support in the Senate Finance Committee, whether it is standalone legislation or through a markup of previously introduced legislation where these reforms could be included.