Beam Me Up: Audit Exposes Record of Waste at IRS Conferences

Taxpayers Protection Alliance

June 6, 2013

IRS spent over $50,000 on videos for conferences according to an Inspector General Report

The Internal Revenue Service is under intense scrutiny as new information on the scandal involving the deliberate targeting of conservative groups continues to be uncovered, with the latest being congressional testimony offered yesterday by individuals who were directly targeted by the IRS as they were seeking to form their own independent organizations. The Taxpayers Protection Alliance issued a strong statement just after this story broke, and now yet another report out this week from the Treasury Department sheds light on another scandal, the IRS’s spending on conferences during fiscal years 2010-2012.

The major highlights of the report reveal an agency that has wasted millions of dollars on needless activities and what is worse is that during this time procedures during conferences did not require the IRS to track and report actual conference costs. The report focuses widely on the SB/SE Division All Managers Continuing Professional Education (CPE) conference held in Anaheim, CA, which cost a staggering $4,133,183. This was the most expensive of all the conferences held during the 2010-2012 period, and thus the Inspector General looked closely at the expenses of this event. The real waste to taxpayers can be seen as we learn how these events were put together and the excessive spending on things that seem to be nothing more than frivolity:

Guest speakers, some who double as artists:

“One keynote speaker was contracted to perform two keynote speeches that lasted approximately one hour each, and the speaker was paid $17,000. According to the contract signed by the IRS, this speaker was “uniquely qualified to deliver this presentation because of the combination of his artistic abilities and his presentation skills. In each presentation, he will create a unique painting that reinforces his message of unlearning the rules, breaking the boundaries, and freeing the thought process to find creative solutions to challenges.” The speaker created six paintings at these two keynote sessions (three at each session). These paintings consisted of the following portraits: Albert Einstein (one); Michael Jordan (one); Abraham Lincoln (one); U2 singer Bono (one); and the Statute of Liberty (two). At each session, one attendee was selected by the speaker and presented with one of the paintings.”

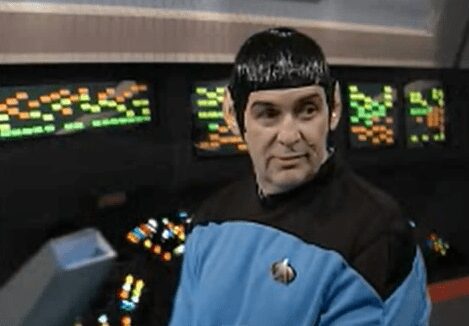

Parody videos produced for the conference:

“As previously stated, the IRS reported that it expended $50,187 on “videos” for the conference, but was unable to provide any details supporting this cost. We determined that SB/SE Division management showed several videos at the conference, including a Star Trek parody and another video entitled “SB/SE Shuffle.” The conference theme was “Leading into the Future,” with a Star Trek parody video shown at the beginning of the conference. This video consisted of a scripted presentation featuring SB/SE Division executives portraying Star Trek characters in a tax-themed parody. SB/SE Division management stated that the purpose of the video was to open the conference by highlighting “current issues facing the IRS and SB/SE [Division] in the leadership arena and set the stage for the many topics being covered at the conference.” According to SB/SE Division management, the SB/SE Division Commissioner verbally approved the creation of the video.”

The conference featured 15 outside speakers costing a total of $135,350:

“The IRS paid for 15 outside speakers and offered additional workshops conducted by IRS management. Appendix X shows that 24 workshops (“knowledge portals”) were presented on the second day of the conference (10 workshops conducted by IRS speakers and 14 workshops presented by external speakers paid by the IRS). These workshops were conducted multiple times (generally four times by each speaker) during this day. As a result, attendees could choose from between 22 to 23 different workshops at each of the four workshop session times that could be attended. Because 10 of these workshops were conducted by IRS personnel, some attendees may not have viewed any of the workshops conducted by the paid external speakers.”

Many conference attendees received hotel room upgrades:

“As part of the Letters of Intent with the hotels, the IRS received a certain number of free rooms per night as well as suite upgrades that were used by IRS personnel. Federal employees traveling for work are paid for their lodging costs plus a fixed amount for meals (per diem). As part of the agreement, the hotels charged the IRS the Federal Government rate of $135 per night for all rooms (including suites) provided. Specifically, the Letters of Intent indicate that 93 suite upgrades were provided by the Hilton, 33 by the Marriott, and six by the Sheraton each night of the conference. This represents 4.7 percent of the 2,830 rooms that the hotels agreed to reserve in the Letters of Intent. Although the per diem rate of $135 was charged by the hotels, we determined the rack rates13 for the upgraded rooms provided ranged from $299 per night to $1,500 per night, depending on the room and the hotel. For example, the Commissioner, SB/SE Division, stayed five nights in a Presidential Suite at the Marriott. This room is described as having a private bedroom, living area, conference table, wet bar, and billiard table. We spoke with a Marriott representative who stated that this suite currently retails for $3,500 per night.14 The Deputy Commissioner, SB/SE Division, stayed five nights in a two-bedroom Presidential Suite at the Hilton. The IRS paid the standard per diem rate of $135 per night for the room, which would have normally cost guests $1,499 per night during a four night stay. Figure 3 shows a Presidential Suite at the Hilton hotel.”

This was just one list of examples at one conference in a two year period… when the total bill is rung up, taxpayers were hit with nearly $50 million in costs as a result of the 225 conferences held by the Internal Revenue Service between 2010 and 2012. America is witnessing the unraveling of abusive practices and frivolous waste by an agency whose purpose is to collect the tax dollars our government. The fact that they are acting irresponsibly by purposely targeting groups based on ideology and spending egregious amounts of agency money on pointless conferences filled with wasteful spending shows just how out of touch and out of control the IRS is today. There must be more done to reign in the organization with regards to both how they do business and how they allocate the funds granted to them by way of the taxpayer.