Philadelphia Creates New Taxpayer Funded Position After Creating Soda Tax

Taxpayers Protection Alliance

August 2, 2016

Excise taxes are among the most harmful taxes imposed on lower and middle- income people. And, unfortunately, state and local governments have a strong penchant for implementing these burdensome taxes. In addition to disproportionately affecting people, they also harm small businesses, and rarely (if ever) generate the projected revenue that many of the proponents say they will. Knowing all of these concerns, these taxes still frequently pass in cities all across the country, including Philadelphia, Pa. where a new soda tax was passed.

The new Sweetened Beverage Tax, will impose a 1.5 cents-per-ounce tax on more than 1,000 beverages and will go into effect on January 1, 2017. The Taxpayers Protection Alliance (TPA) strongly opposed the tax as it was being debated. TPA was part of a broad coalition that urged the city council not to adopt Mayor Kenny’s new tax. In fact, the coalition (led by Capitol Allies) sent a letter to the city council before the vote laying out all the problems that the tax would place on families all across the city of Philadelphia:

The Grocery Tax will rob many families and individuals of precious dollars from their household budgets. Fewer jobs and less income will mean many parents will spend less time with their children. Keeping children from their parents and families—their first, best teachers—ironically undermines what the Mayor hopes to achieve through universal pre-K.

Lawmakers ignored the legitimate concerns put forth in the letter, and they ignored the 58 percent of residents who opposed the measure. On June 16, 2016 by a vote of 13-4, the Philadelphia City Council passed the new tax and the litany of explanations given ranged from denial to ignorance. Councilman Mark Squilla stated that “…the tax will fund three major initiatives the my constituents strongly support (Pre – K, Community Schools, rebuild for our Parks, Rec facilities, Libraries, etc.).” Does that mean councilman Squilla wants children and adults to drink more soda?

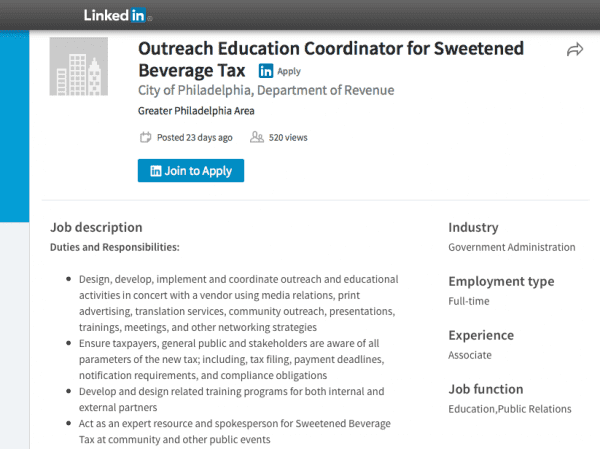

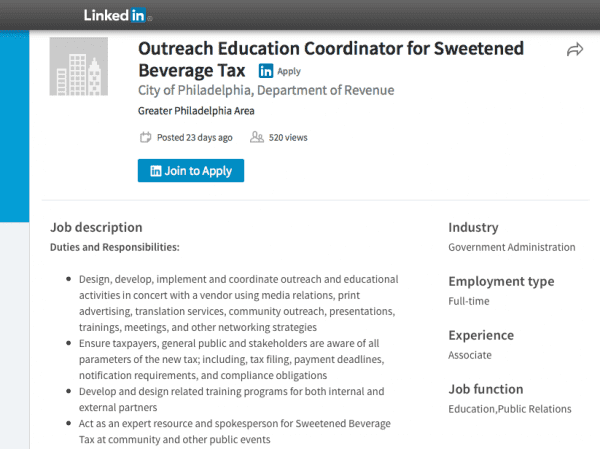

Now, adding insult to injury on taxpayers all across the city, a new taxpayer-funded job, Outreach Education Coordinator for Sweetened Beverage Tax, has been created by the Philadelphia government just days after passing the new tax. The job is housed within the city’s Department of Revenue and will be a full-time position. The photo below gives a full description of the new position:

This new job will add to the city’s already very problematic budget and will rely on revenue from taxpayers that lawmakers say they are having a problem generating. This logic defies common sense and there’s absolutely no reason for the creation of a new government job solely to “educate” people on a tax increase that is already unpopular months before it will be hitting their wallets. With a clear majority in opposition, it sounds like Philadelphians are already well educated about the new soda tax.

Many of the proponents of the new tax argue that it is a way to fix a budget shortfall. This is the usual excuse that many government officials use to rationalize a tax increase. But now, only days after passing a tax that is designed to bring revenue in to help a problem with the budget, the city of Philadelphia is creating a new government job costing taxpayers even more money.

TPA is calling on Frank Breslin, the Commissioner of the Philadelphia Department of Revenue, to immediately eliminate the position and save taxpayers money. The new tax and the new position are insulting, they makes no sense, and they are fiscally irresponsible.