FTC and DOJ Merger Guidelines Harm Competition

Dan Savickas

July 21, 2023

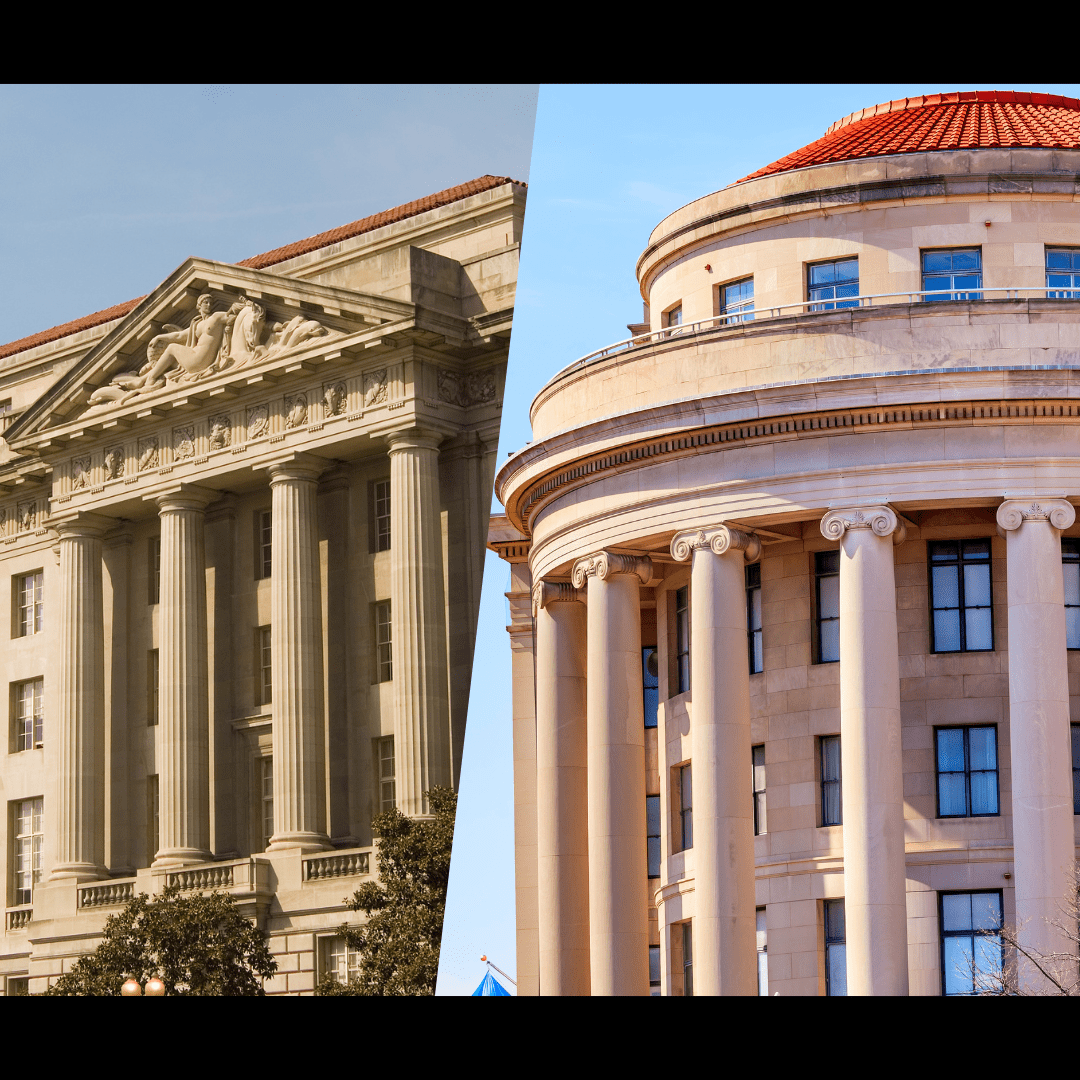

Just days after President Biden announced that “Bidenomics is about increasing competition, not stifling competition,” the Federal Trade Commission and Department of Justice (DOJ) handed down new merger guidelines. As is the case with most everything that comes out of the FTC recently, the new guidelines will, in fact, stifle competition. The new guidelines are vague at best and will discourage economic activity that leads to innovation and investment.

FTC Chair Lina Khan and her DOJ counterpart Assistant Attorney General Jonathan Kanter released the blueprint for these new guidelines on Wednesday. That came nearly a week after Khan had testified before the House Judiciary Committee regarding oversight of her agency. Among the lines of questioning Khan faced was one from Rep. Kevin Kiley (R-Calif.). Rep. Kiley noted that Khan has never won a merger trial as Chair of the FTC and speculated Khan is losing on purpose to initiate legislative change.

The Khan FTC’s poor track record in merger proceedings is informative when considering these new guideline proposals. Part of the ethos at the FTC has been to initiate action against companies regardless of the merits. Whether or not the law is on their side, the FTC brings lawsuits against acquisitions hoping the long, protracted legal process will serve as a deterrent in and of itself. Khan does not have the legal footing, but many companies will want to avoid the hassle and cost.

Given the vague language in the 13-point guidelines released by the FTC and DOJ on Wednesday, it appears there is no intent to stop this foolish strategy. For example, point 1 stipulates, “Mergers should not significantly increase concentration in highly concentrated markets.” Point 2 goes on, “Mergers should not eliminate substantial competition between firms.” Rounding out the first three points, point 3 states, “Mergers should not increase the risk of coordination.”

Any literate observer will note the fungible language in just these first three points. How is one to know what a “significant” increase in concentration is and whether or not a market is considered “highly” concentrated already? How can a company know whether “substantial” competition has been eliminated. Are companies expected to know whether or not their acquisition “increases the risk” of coordination, even if there is no discernible coordination to be seen? All of this is up to the discretion of FTC bureaucrats under these guidelines.

A similar, potentially destructive point is made with the ninth point in the new guidelines, “When a merger is part of a series of multiple acquisitions, the agencies may examine the whole series.” If a company draws the ire of the FTC or DOJ, then any other acquisitions they have made in the recent past are fair game for legal action – even if there was no reason to suspect harm in the first place.

The FTC’s new guidelines provide neither clarity nor certainty. Perhaps, that is the ultimate point. Khan’s FTC in particular has demonstrated this antitrust vision cannot win in the courts with the law where it is today. The new strategy is to levy soft threats through vague guidelines such as these. Companies may be able to win in court, but they’ll have to spend years of time and millions of dollars to do so. If the feds can’t stop them in court, they’ll stop them by making sure they never risk beginning. That is a poor way to conduct public policy.

Dan Savickas is Director of Policy at Taxpayers Protection Alliance.