TPA Releases Report on Top 5 Most Ridiculous Taxpayer Tourist Traps

David Williams

September 14, 2011

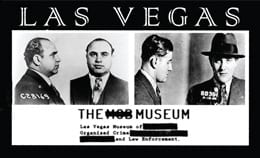

Today, the Taxpayers Protection Alliance (TPA) released a report (click here for the full report) on the “Top Five Most Ridiculous Taxpayer Tourist Traps” in America. The report highlights five museums across the nation that are paid for with dollars taken from taxpayers’ pockets. The report was written by TPA senior fellow Drew Johnson. The tourist traps highlighted in the report include the Mob Museum in Las Vegas, Nevada which has cost taxpayers $16.2 million but has yet to open, as well as the First Ladies National Historic Site in Canton, Ohio, which receives $1 million annually from taxpayers.

Every summer millions of Americans hit the open roads, traveling near and far on vacation. Museums and historic homes such as the Smithsonian museums in Washington, DC, Elvis Presley’s Graceland in Memphis and New York City’s American Museum of Natural History are always high on the list of the most popular vacation destinations for families.

America is a country full of museums. In fact, according to the American Association of Museums, there are at least 17,500 museums in the United States. What many Americans don’t know is that all levels of government are subsidizing these museums through a myriad of grants and earmarks. The Taxpayers Protection Alliance looks at a handful of taxpayer-funded museums and vacation points of interest in its latest expose, The Top 5 Most Ridiculous Taxpayer Tourist Traps.

At the center of the funding of this collection of taxpayer-subsidized museums and historic homes is the National Park Service’s Save America’s Treasures (SAT) program. Established in 1998 by President Clinton, SAT requires that funding from the federal government be matched by other sources of funding. Since there is no mandate requiring that the “other” funds come from private sources, additional state or local tax dollars are often used to match the federal funds. As a result, taxpayers may pay two or even three times to fund the same project.

Traditionally, half of the SAT’s federal funds are awarded through a competitive process administered by the NPS and the National Endowment for the Arts. The other half is reserved for congressional earmarks. Initially, the funds for SAT were for the restoration of the Declaration of Independence, the Constitution, and the flag that inspired our national anthem. All money spent by the program was supposed to be competitively awarded. Unfortunately, Congress had other ideas and turned the program into a conduit of pork.

Even though the program was successfully defunded the last two fiscal years, SAT still intends to give out more than $14 million in fiscal year 2011, showing that there is plenty of a backlog of money to keep the docents decently busy.

President Obama’s fiscal year (FY) 2012 Terminations, Reductions, and Savings report recommended the elimination of the program because “at least half of SAT projects are annually earmarked by Congress, without using merit-based criteria.” With even stronger criticism in FY 2011, the President stated that SAT “has not demonstrated how it contributes to nationwide historic preservation goals,” and that its demise would allow the National Park Service to “focus resources on managing national parks and other activities that most closely align with its core mission.” Further, SAT’s initiatives are largely duplicative of those already funded and carried out by the National Historic Preservation Act.

All of the examples in this report also received local and/or state money as well so, as you flip through the pictures of your summer vacation, remember that the government never takes a break from spending your tax dollars.

Here are the Top Five:

- The Mob Museum—Las Vegas, Nevada: Cost to Taxpayers: $16.2 million, so far. And it’s not even open

- International Quilt Study Center and Museum—Lincoln, Nebraska: Cost to taxpayers: $102,977

- First Ladies National Historic Site—Canton, Ohio: Cost to Taxpayers: $1 million per year

- The Herschell Carrousel Factory Museum—North Tonawanda, New York: Cost to Taxpayers: $410,431 since 2005

- The Mark Twain House and Museum—Hartford, Connecticut: Cost to Taxpayers: $7.1 million since 2000

Across the United States, museums and historic sites thrive without the assistance of handouts from taxpayers. Americans are happy to pay entrance fees and donate money to protect pieces of history and keep important sources of information alive. When politicians and bureaucrats take hard-earned dollars from taxpayers to subsidize failing tourist traps that are ill-conceived, poorly run or the beneficiary of pork barrel politics, however, it is a disservice, both to taxpayers and to every other tourist destination in America. Each dollar pilfered from the pockets of taxpayers and given to a tourist destination favored by a politician is one less dollar that taxpayers can use to take their family to visit an attraction that they deem worthy of their support.