TPA Hosts Bipartisan Tax Reform Hill Briefing

Taxpayers Protection Alliance

July 8, 2016

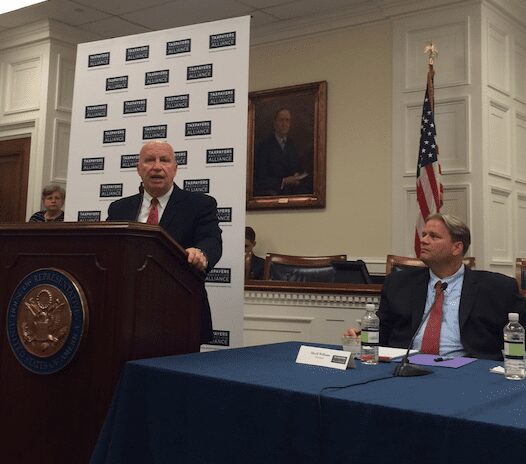

House Ways and Means Committee Chairman Kevin Brady

Yesterday, the Taxpayers Protection Alliance (TPA) held a briefing on Capitol Hill on comprehensive tax reform titled “Independence Day 2.0: Freedom from our outdated tax code.” There was a lot of interest in the event which is not surprising because tax reform is one of the largest policy discussions happening today. While everyone has a different opinion on how it should be accomplished, there is one thing that nearly all of us can agree on and that is that comprehensive tax reform is long overdue.

The event began with opening remarks from TPA President David Williams and a short clip of TPA’s 2016 Tax Day Man on the Street video (you can see the full version here). The video showed attendees and members of Congress that working Americans are frustrated and Congress to fix the broken tax code.

Two distinguished members of Congress, House Ways and Means Committee Chairman Kevin Brady (R-Texas) and Republican Study Committee Chairman Rep. Bill Flores (R-Texas), spoke at the briefing.

Chairman Brady laid out specific details of the tax reform blueprint that he released just a few weeks ago. Chairman Brady stressed the key components of the blueprint including simplifying the code, reducing the corporate tax rate, reforming the IRS, and repealing the death tax. Rep. Flores (R-Texas) discussed the need for comprehensive tax reform and introduced one of the panelists, Rebecca Boenigk.

With TPA President David Williams moderating the event, the panelists for the event included:

- Rebecca Boenigk, CEO and Chairman of Neutral Posture, Inc.

- Pete Sepp, President of National Taxpayers Union

- Simon Rosenberg, President and Founder of New Democrat Network

The discussion from the panel focused on a number of area issues regarding the need for tax reform and how to get there.

Our panel: David Williams, Rebecca Boenigk, Pete Sepp, and Simon Rosenberg

As a small business owner, Rebecca Boenigk was able to describe the everyday issues related to taxes that she must deal with as a business owner and why the complicated tax code continues to hold back the maximum potential for growth and expansion. And not just for her company, Neutral Posture, Inc., but for every small business entrepreneur in the United States. The voice of those in the business community is critical to getting tax reform done right and that is why it was important to hear from Ms. Boenigk.

As the head of the nation’s oldest taxpayer advocacy group, National Taxpayers Union President Pete Sepp skillfully laid out the problems with the complicated tax code and why it continues to be an impediment to the economy, job growth, and regaining our competitive edge around the world. Mr. Sepp also tapped into some of the current barriers that the tax code puts on the taxpayer and why it is so difficult for many individuals and businesses to get tax compliance done in a timely and inexpensive manner.

Rounding out the panel, and making it a truly nonpartisan discussion, Simon Rosenberg of the New Democrat Network gave us his perspective. Rosenberg talked about how the political climate will impact tax reform. Rosenberg was also to apply the politics of tax reform into the overall landscape of how a path forward may look in order to get something done. Mr. Rosenberg’s unique experiences in Washington brought a welcome perspective to the panel that touched on how bipartisan comprehensive tax reform is an achievable goal, even as the political environment continues to shift.

The event concluded with questions for the panel and the message was clear: simplification of the tax code is a shared goal, and lawmakers and stakeholders on all sides agree that comprehensive tax reform is critical to boosting our economy and helping working families all across the United States.

We want to thank everybody who attended and for those who didn’t attend, click here for video of the full event.