Testimony before the Washington House Finance Committee Regarding Increasing the Tax Rate on Vapor Products

Taxpayers Protection Alliance

January 13, 2022

Chairwoman Frame, Vice Chairs, and members of the Committee,

Thank you for your time today to discuss the issue of increasing the state excise tax rate on vapor products. My name is Lindsey Stroud, and I am Director of The Taxpayers Protection Alliance’s (TPA) Consumer Center. TPA is a non-profit, non-partisan organization dedicated to educating the public through the research, analysis and dissemination of information on the government’s effects on the economy. TPA’s Consumer Center focuses on providing up-to-date information on adult access to goods including alcohol, tobacco and vapor products, as well as regulatory policies that affect adult access to other consumer products, including harm reduction, technology, innovation, antitrust and privacy.

Vape Tax History in Washington

In 2019, lawmakers in the Evergreen State – including some sponsors of this current bill – passed House Bill 1873 which established a state excise tax on electronic cigarettes and vaping devices.

Interestingly, in 2019, lawmakers recognized the vast differences in vapor products, including types that are more attractive among youth users, and created a tax structure that taxes such products at different rates.

Under current law, closed, pod systems such as JUUL or disposables, are taxed at $0.27 per ml. Comparatively, open systems, most commonly used by adults and former smokers, are subject to a $0.09 per ml tax.

Per the legislation, 50 percent of the revenue generated by the tax is to be distributed to the Andy Hill cancer research endowment fund match transfer account and the remaining 50 percent is to be allocated to the foundational public health services account.

Of the 50 percent of vape tax revenue that is being allocated to foundational public health services, $12 million must be used to “fund foundational health services. Only 17 percent of the 50 percent of funds being used for foundational public health are to be distributed to “fund tobacco, vapor product, and nicotine control and prevention, and other substance use prevention and education.”

Vapor Economics: Washington

Despite being an excellent tool to help adult smokers quit combustible cigarettes, lawmakers’ actions in the Evergreen State have negatively impacted the vaping industry.

In 2021, according to the analysis by the Vapor Technology Association, the industry created 1,285 direct vaping-related jobs in Washington. These jobs generated more than $58.3 million in wages. Moreover, the industry has created hundreds of secondary jobs in the Evergreen State, bringing the total economic impact in 2021 to $399.3 million. In the same year, Washington received more than $37.6 million in state taxes attributable to the vaping industry.

Unfortunately, efforts by anti-vaping organizations and policymakers have negatively affected vape shops in the Evergreen State. The number of employees has decreased by 35.6 percent from 1,995 in 2018 to 1,285 in 2021, representing a loss of $10.5 million in wages. Further, state tax collections in 2021 were down 6.2 percent from 2018’s level of $40.1 million. Overall, the economic output from the vaping industry in Washington was reduced from over $483.7 million in 2018 to $399.3 million in 2021, a 10.5 percent decrease.

Wasted Tobacco Dollars

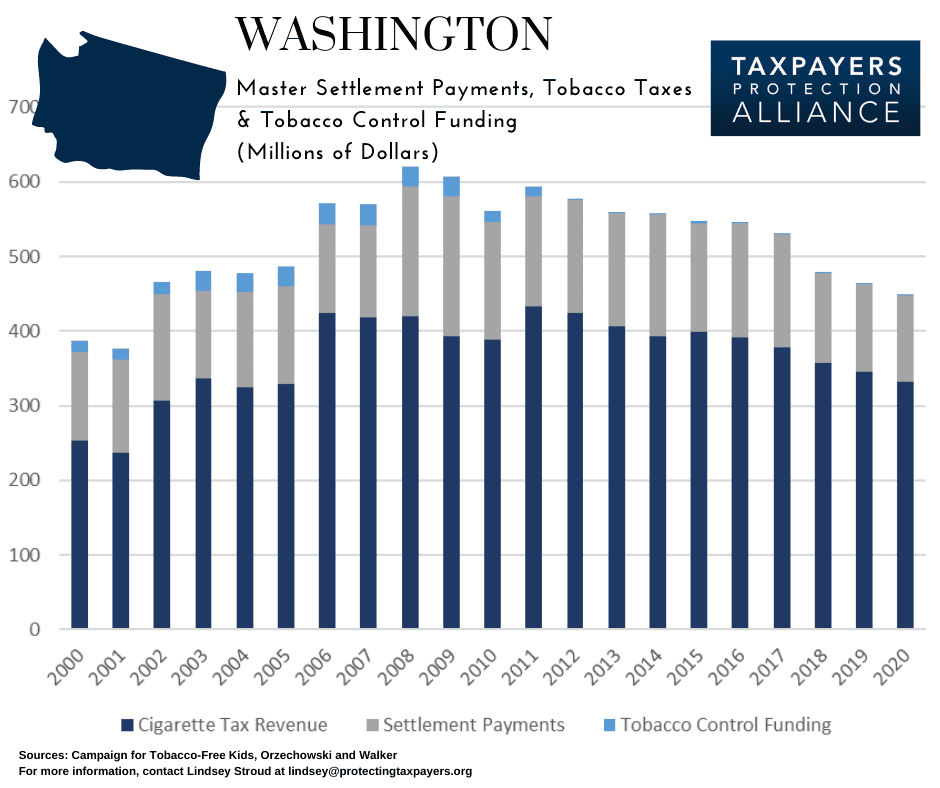

Between 2000 and 2020, Washington collected an estimated $7.7 billion in cigarette taxes. During the same 20-year period, the Evergreen State increased the tax rate on cigarettes three times. The last tax increase raised the rate by $1.00, to $3.025 per pack.

The last tax increase did lead to an immediate 11.5 percent increase in cigarette tax revenue the year after the tax was imposed, but this has steadily declined in the long-term. Between 2012 and 2020, cigarette tax revenue declined on average by 2.9 percent annually. In 2020, Washington collected $331.3 million in cigarette tax revenue, a 23.4 percent decrease from the $432.7 million in cigarette tax revenue that was collected in 2011.

In the mid-1990s, Washington sued tobacco companies to reimburse Medicaid for the costs of treating smoking-related health issues. And, in 1998 with 45 other states, the Evergreen State reached “the largest civil litigation settlement in U.S. history” through the Master Settlement Agreement (MSA).

Under the MSA, states receive annual payments – in perpetuity – from the tobacco companies, while relinquishing future claims against the participating companies. Between 2000 and 2020, Washington collected $2.9 billion in MSA payments.

Tobacco taxes and tobacco settlement payments are justified to help offset the costs of smoking, as well as prevent youth initiation. Like most states, Washington spends very little of existing tobacco moneys on tobacco control programs – including education and prevention.

Between 2000 and 2020, Washington allocated only $278.8 million in state funds towards tobacco control programs. This is 3.6 percent of what the state collected in cigarette taxes in the same 20-year time span and 9.5 percent of MSA payments. In total, in 20 years, Washington allocated only 2.6 percent of what the state received in tobacco taxes and settlement payments towards tobacco education and prevention efforts. In essence, for every $100 received in tobacco-related taxes and settlement payments, the state spent $2.60 funding tobacco control programs.

Vapor Product Emergence Correlates with Lower Young Adult Smoking

Electronic cigarettes and vapor products were first introduced to the U.S. in 2007 “and between 2009 and 2012, retail sales of e-cigarettes expanded to all major markets in the United States.” Moreover, between September 2014 and May 2020, e-cigarette sales in the U.S. increased by 122.2 percent.

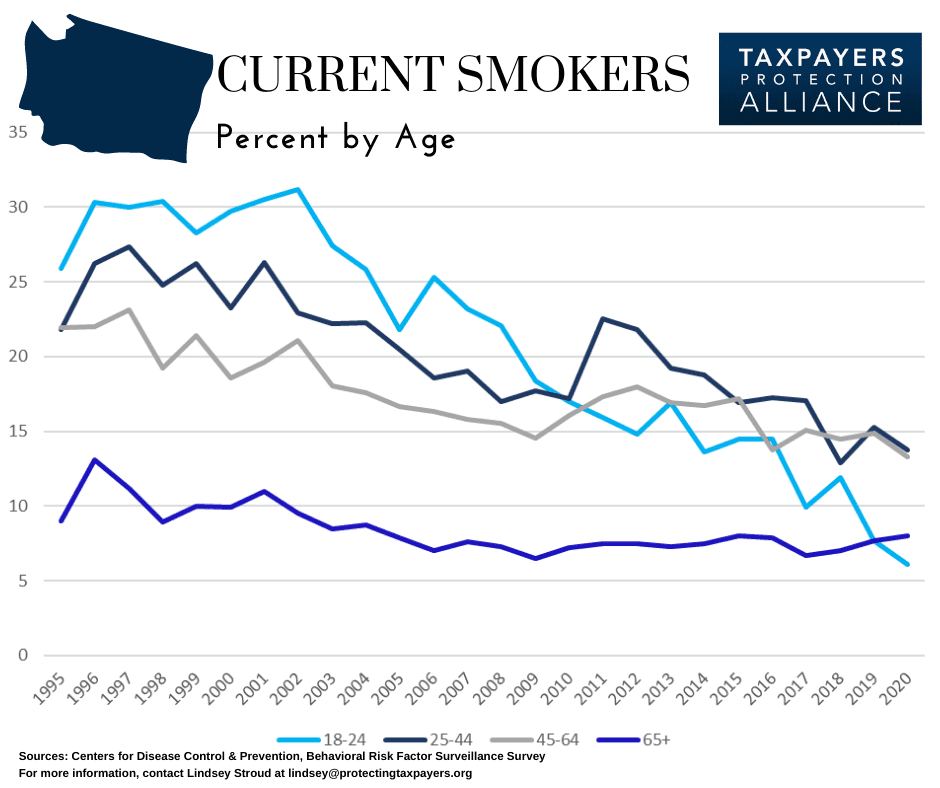

Examining data from the CDC’s BRFSS finds that e-cigarettes’ market emergence has coincided with a significant reduction in smoking rates among young adults.

In 1998, among current adult smokers, 30.4 percent were 18 to 24 years old. In 2008, this had decreased by 27.3 percent to 22.1 percent of adult smokers in Washington being between 18 to 24 years old.

In the years after e-cigarette’s market emergence in the early 2010s, smoking rates among current smokers aged 18 to 24 years decreased by 64.1 percent. Indeed, in 2010, among current smokers in Washington, 17 percent were between 18 to 24 years old. In 2020, only 6.1 percent of current smokers were 18 to 24 years old.

Interestingly, e-cigarettes’ market emergence was associated with greater declines in average annual percent decreases. Between 1998 and 2008, the percentage of current smokers aged 18 to 24 years old decreased on average by 2.7 percent each year. Between 2010 and 2020, annual percentage decreases average at eight percent.

Further, since 2016, when the U.S. surgeon general issued an alarm about youth e-cigarette use, smoking rates among adults aged 18 to 24 years in the Evergreen State have decreased by 57.9 percent, with an average annual decrease of 13.5 percent.

Vapor Product Use Among Washington Youth

The most recent report on youth e-cigarette use in Washington is from the 2018 Healthy Youth Survey, which surveyed 6th, 8th, 10th, and 12th graders in Washington. Among past 30-day use, 97 percent of 8th graders and 89.5 percent of 8th graders reported not using an e-cigarette in the 30 days prior to the survey.

Among 10th and 12th graders, 21.1 percent and 29.5 percent reported using a vapor product on at least one occasion in the 30 days prior respectively. Among both 10th and 12th graders, 74.6 percent reported not using a vapor product. Only 5.2 percent of Washington 10th and 12th graders reported daily e-cigarette use.

It should be noted that many youths in Washington are not relying on the internet to obtain e-cigarettes and vapor products. In 2018, only 1 percent of 8th graders, 1.4 percent of 10th graders and 1.5 percent of 12th graders reported using the internet to purchase vapor products.

Conversely, 3.9 percent of 8th graders, 8.1 percent of 10th graders and 9.3 percent of 12th grade indicated they had borrowed vapor products from someone else in the 30 days prior to the survey.

Survey results from 2021 are expected to be published in March, 2022. Despite not having access to Washington-specific youth vaping rates, nationally, the youth vaping rate continues to decline.

In 2021, according to the National Youth Tobacco Survey (NYTS), an estimated 11.3 percent of high school students and 2.8 percent of middle school students reported having used a vapor product on a least one occasion in the month prior to the survey. Further, only 3.1 percent of high school students and less than one percent of middle schoolers reported daily e-cigarette use. The rate of decline is remarkable: among high school students, vaping rates have declined by 41.8 percent since 2020 and by 58.9 percent since 2019, when 27.5 percent reported using e-cigarettes.

Low Income Washingtonians More Impacted by Tobacco and Vapor Taxes

An increase on vapor products would unfairly burden lower income Washingtonians. Excise taxes are inherently regressive and tend to burden lower income persons. For example, a Cato Journal article found from 2010 to 2011, “smokers earning less than $30,000 per year spent 14.2 percent of their household income on cigarettes, compared to 4.3 percent for smokers earning between $30,000 and $59,999 and 2 percent for smokers earning more than $60,000.”

Among current adult smokers in Washington, in 2020, 25.5 percent reported annual incomes of less than $15,000 and 21.9 percent of current smokers reported earning between $15,000 and $24,999 per year. In fact, nearly half (47.4 percent) of all current adult smokers earned less than $24,999 per year in 2020. Only 7.6 percent of current adult smokers in Washington reported earning $50,000 or more a year in 2020.

Interestingly, smoking rates have declined more rapidly among higher income persons in the Evergreen State than their low-income counterparts. Between 1995 and 2020, smoking rates among current smokers earning $24,999 or less decreased by only 18 percent. Conversely, among persons earning $50,000 or more, rates decreased by 47.2 percent during the same period.

Despite providing annual data on cigarette and smokeless tobacco use, the CDC’s BRFSS only reports on adult e-cigarette use for 2016 and 2017.

In 2017, according to the BRFSS, 4.3 percent of Washington adults were current e-cigarette users. Similar to income status among smokers, lower income persons are more likely to use vapor products. In 2017, among current adult e-cigarette users, 13.2 percent reported household incomes of $25,000 or less per year. Conversely, only 3.2 percent reported earning $50,000 a year or more.

Conclusion & Policy Recommendations:

It is disingenuous that lawmakers would purport to protect public health yet tax former smokers by increasing the tax rate on vapor products. Rather than burdening former smokers, lawmakers should utilize existing cigarette tax dollars and invest in robust tobacco control programs – including education and prevention.

- Excise taxes on tobacco and vapor products are regressive and unfairly burden low-income persons. In 2020, 47.4 percent of adult smokers in Washington reported earning incomes of $24,999 or less.

- In 2017, among current adult vapers, 13.2 percent reported incomes of $24,999 or less. Conversely, only 3.2 percent reported earning $50,000 a year or more.

- Washington’s vaping industry created $399.3 million in economic activity in 2021 while generating 1,285 direct vaping-related jobs and contributed more than $37.6 million in state taxes.

- Unfortunately, anti-vaping efforts have reduced the industry’s economic impact. The number of employees decreased by 35.6 percent from 1,995 employees in 2018, and overall economic activity decreased by 10.5 percent from $483.7 million in 2018.

- E-cigarettes’ market emergence is associated with low young adult smoking rates. In 2020, among current smokers in Washington, only 6.1 percent current smokers were 18 to 24 years old – a 64.1 percent decrease from 2010. Further, since 2016, smoking rates among young adults have decreased by 57.9 percent.

- Washington continues to allocate very little of tobacco-related settlement payments and taxes on tobacco control programs, including education and prevention.

- In 2020, the Evergreen State collected $331.3 million in state cigarette excise taxes and $116.6 million in tobacco settlement payments, yet allocated only $2.1 million (0.5 percent) to tobacco control. In 20 years, for every $100 the state received in tobacco-related payments, it spent $2.60 funding tobacco control programs.

Supplemental Graphs

- Tobacco Monies

2. Smoking Rates by Age

References

1 Washington State Legislature, “House Bill 1873,” 2019-20, https://app.leg.wa.gov/billsummary?BillNumber=1873&Year=2019&initiative=.

2 Vapor Technology Association, “The Economic Impact of the Vapor Industry Washington,” 2021, https://vta.guerrillaeconomics.net/reports/6eecfd69-222f-44e1-9e7d-aae7beaaec60?.

3 Vapor Technology Association, “The Economic Impact of the Vapor Industry Washington,” 2018, https://vta.guerrillaeconomics.net/reports/7e62a55c-b3cc-4903-8e61-8f69d43288cc?.

4 Orzechowski and Walker, “The Tax Burden on Tobacco Historical Compilation Volume 55,” 2020. Print.

5 Tobacco Control Legal Consortium, “The Master Settlement Agreement: An Overview,” August 2015, p. 1, http://publichealthlawcenter.org/sites/default/files/resources/tclc-fs-msa-overview-2015.pdf.

6 Campaign for Tobacco-Free Kids, “Actual Annual Tobacco Settlement Payments Received by the States, 1998 – 2000,” August 13, 2020, https://www.tobaccofreekids.org/assets/factsheets/0365.pdf.

7 Campaign for Tobacco-Free Kids, “Appendix A: History of Spending for State Tobacco Prevention Programs,” 2021, https://www.tobaccofreekids.org/assets/factsheets/0209.pdf.

8 National Center for Chronic Disease Prevention and Health Promotion, “E-Cigarette Use Among Youth and Young Adults: A Report of the Surgeon General,” 2016, https://www.ncbi.nlm.nih.gov/books/NBK538679/.

9 Fatma Romeh M. Ali, PhD., et al., “E-cigarette Unite Sales, by Product and Flavor Type – United States, 2014 – 2020,” Morbidity and Mortality Weekly Report, Centers for Disease Control and Prevention, September 18, 2020, https://www.cdc.gov/mmwr/volumes/69/wr/mm6937e2.htm/.

10 Washington State Department of Health, “Healthy Youth Survey,” 2018, https://www.doh.wa.gov/DataandStatisticalReports/DataSystems/HealthyYouthSurvey.

11 Eunice Park-Lee PhD. et al., “Notes from the Field: E-Cigarette Use Among Middle and High School Students – National Youth Tobacco Survey, United States, 2021,” Morbidity and Mortality Weekly Report, Centers for Disease Control and Prevention, October 1, 2021, https://www.cdc.gov/mmwr/volumes/70/wr/mm7039a4.htm.

12 1 Kevin Callison and Robert Kaestner, “Cigarette Taxes and Smoking,” Regulation, Cato Institute, Winter 2014-15, https://object.cato.org/sites/cato.org/files/serials/files/regulation/2014/12/regulation-v37n4-7.pdf.