A Prime Day for Some Perspective on Online Retail Market

Patrick Hedger

June 22, 2021

It’s shaping up to be quite the week for Amazon. Monday and Tuesday mark Amazon’s “Prime Day,” its largest annual sales event. On Wednesday, the House Judiciary Committee is scheduled to begin marking-up a package of five antitrust bills designed to target the online retail giant, along with other major tech companies. While all eyes will be on Amazon for one reason or another, it’s important to remember Amazon, while certainly the largest player in the online retail space, is not the invincible “monopoly” some make it out to be.

Let’s take a quick look at how other retailers in the ecommerce space have done since Amazon’s first Prime Day in 2015. We’ll first look closely at large general retailers, Walmart and Target.

Walmart:

Walmart remains the largest overall retailer in the United States. While most of its sales occur at its traditional brick-and-mortar locations, it has become the second largest player in the eCommerce space, recently surpassing eBay.

In 2015, Walmart’s online sales were estimated by multiple sources to be around $12-14 billion.

Today, eMarketer projects Walmart will do $64.62 billion in ecommerce sales in 2021.

Target:

Target remains a significant player and household name in the U.S. retail sector. It now boasts a rapidly growing digital presence as well.

In 2015, Target did roughly $2.5 billion in online sales.

In 2021, eMarketer projects Target will do $20.23 billion in online sales.

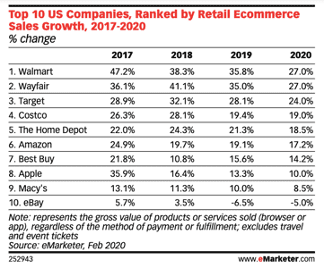

Walmart and Target are the closest substitutes to Amazon, selling a wide range of consumer products from groceries to electronics. It’s important to note, however, that other more-niche retailers such as Wayfair, Best Buy, and Home Depot are also seeing significant growth in their online sales. Many of these firms are seeing online sales growth rates that rival, if not exceed Amazon’s and directly challenge Amazon in several retail product categories.

There’s no denying that Amazon is far-and-away the largest player in online retail, but it’s important to keep a wide perspective on the market. First and foremost, online retail as a whole, while steadily growing, was only about 11 percent of the entire retail sector prior to the pandemic. And there will always be inherent advantages to brick and mortar retail over online sales for many customers in many situations, such as needing to see something in person before purchasing or needing it right away.

In addition, if current trends continue, Amazon’s significant position in online retail may no longer be the case in fairly short order. After all, it wasn’t very long ago that almost all of the same arguments about Amazon’s size and scope were made about Walmart.

Patrick Hedger is the Vice President of Policy at Taxpayers Protection Alliance